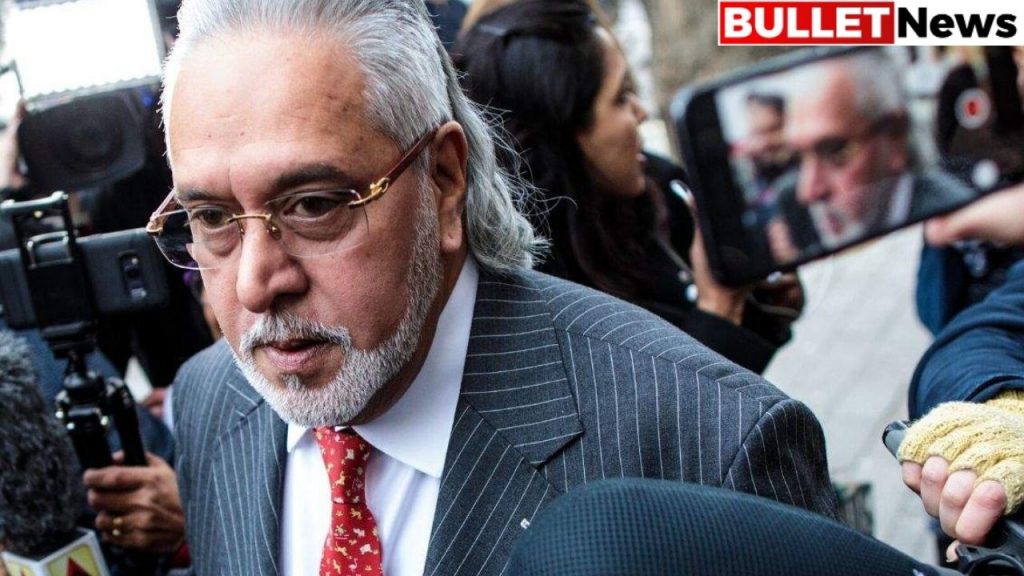

Five years after Liquor Raja Vijay Malla flew to England, about seven years after gave Rs 9,000 Crore loans to Kingfisher Airlines marked by Tagged NPA (non-performing assets). The Bank finally succeeded in making a meaningful recovery from challenging to understand Understood. Baron. It was a significant victory for the Bank’s consortium led by SBI against strong company promoters.

On June 23, as was first reported by MoneyControl, the Bank recovered Rs 5,800 Crore by selling Vijay Mallya shares in United Breweries to Heineken International. The Bank sells 15 per cent of the shares in the company for Heineken. Previously, the Bank had sold shares worth 1,357 crores and plans to sell shares worth Rs 800 Crore on June 25, according to a report. So far, the Bank has recovered Rs 7.1 82 crores from Vijay Mallya through stock sales, which is slightly more than 70 per cent of the number that owes lenders.

Mallya owes around Rs 10,000 Crores to Indian bank clutches led by the Indian state bank (SBI) if a person considers the flower components that still have to be paid or even higher.

Heineken got the exception of an open offer of the effects and Exchange Board of India (SEBI) to buy additional bets. The development came after the Indian competition commission (CCI) on June 21 said it had agreed to acquire the Heineken International BV proposal from additional equity shares at United Breweries (UBL).

Since Mallya flew to England, banks were locked in a lengthy legal battle in several courts to get their money back. Most bankers signed a check to Kingfisher has retired from the service. Others lose hope about meaningful recovery. For them, there is a sense of victory now in this case. With the government cancelling Mallya’s passport in April 2016 and India encouraged the extradition of entrepreneurs, this case has grown outside the case of banker-corporate details. Intense media supervision and political comments made the Vijay Maliya case a battle of ego and political problems.

Tweet Mallya, in this case, his promises that are not clear from full payment to the Bank and depiction of themselves as victims of wizard hunts by Indian investigative institutions add high drama. “By taking a passport or capturing me, they did not get money,” Mallya told Mally Financial in April 2016. In his first interview after leaving the country on March 2. With seven bags and unknown women to England and for a moment after receiving a separation of RS 500 crore from Diageo. After resigning as chairman of United’s Spirit.

In addition to SBI, lenders for Kingfisher Airlines include Punjab National Bank, IDBI Bank, Bank Baroda, Allahabad Bank, Federal Bank, and Axis Bank. This lender provides loans to Mallya for several years with intangible companies such as the company’s brand and goodwill and Malla’s guarantee.

Mallya’s guarantee allows banks to claim personal assets, including equity.

But why do banks don’t advance and sell previous shares? That’s because there is a court stay that prohibits banks sell securities in the name of Mallya. Also, there is attachment ed on these assets, making it difficult for banks to act.